Is money to rain from the mashinani heavens?

I’m not an economist. But I do know one thing: you cannot remove blood from a stone. Once upon a time there lived a King who ruled over a large kingdom and efficiently taxed his subjects. Every six months, each household had to give a pregnant goat to the village administrator. Once the goat had given birth, the administrator would keep one of the kids as his reward and pass the mother goat and the remaining kids to the King. But some of the village administrators started getting unhappy with their rewards. “Why can’t we keep all the kids and pass the mother goat to the King?” they asked. The King heard about the murmuring amongst some of the administrators and called them to a conference in his palace. “Some of you are unhappy with the reward system of keeping one kid and passing the rest to me. I need all the kids as I use them to feed my soldiers who defend this great kingdom from our enemies. I need the mother goats as I use them to breed with my prize male goats to reproduce even more goats which go into the national coffers. Our kingdom is wealthy and the envy of all the other kingdoms on this continent. If there is a drought, I can feed my people with my goats. Do not try to change the order of things,” he said. But the village administrators, who had now all been convinced of the benefits, stuck to their guns. “The people have sent us here to tell you that we should get two kids each. The people know that we will share the benefits of these kids with them. The people are behind us 100%,” said the self appointed leader of the village administrators. “Alright then,” boomed the King, ”It shall be so. From today henceforth, you shall keep all the kids and send the mother goat to me. But from today henceforth, all households are now required to give me two pregnant goats. Be gone from my presence and good luck explaining to your villagers why your request has ended up doubling their taxes.”

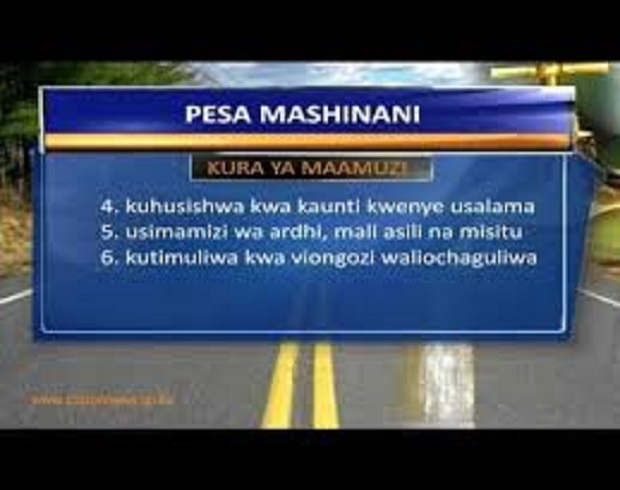

Like I said, I’m no economist. But it doesn’t take an economist to see the end result of this “pesa mashinani” red herring that is being placed before us in the form of a referendum. The wags behind the push claim that the central government should send even more money to the counties for ultimate distribution in development projects. The central government has a finite source of funds, the bulk of which are derived from taxing you, the Kenyan citizen. You are taxed on your salary via pay as you earn, on the goods and services you purchase via value added tax, on the equipment and cars you import via import duty, on the profits you make as you do business via income tax and the list goes on. The government also has an almost infinite use for those revenues: salaries have to be paid, domestic and foreign debt must be repaid, roads, ports and bridges have to be built…you’re getting my drift. If more funds are sent to the counties, the central government’s expenditure will not necessarily reduce, as the factors driving expenditure remain constant. A 2013 Ministry of Devolution and Planning report titled: A Comprehensive Review of Public Spending states that since 2008, growth in (central) government consumption surpassed growth in private consumption. In 2007, private consumption expanded by 7.3 percent and government consumption by 4.4 per cent. However from 2009 to 2011 the average growth in private consumption was 2 per cent compared with an average growth rate of 4.3 percent for government consumption.

Brothers and sisters of this our beloved country: the central Kenyan government is a behemoth. A voracious behemoth that is now consuming even more than the private sector if its own reports are to be believed. If more money is sent to the counties (who, with the exception of one or two, have quite brazenly demonstrated their inability to absorb their allocations or spend funds on development activities) then the central government will have no choice but to do one thing: tax us more. Yes, more blood must be squeezed from our unyielding stones because the erudite and well-educated politicians have convinced us natives that our best solution is to have more money for them to spend at the county level. And as the table below shows, we rank average in the league table of tax collection as a percentage of GDP globally, but from an African perspective, we are not doing too badly. We fare the best in the East African Community but pale in comparison to Zimbabwe (shock of shocks it is the number one country globally!), Lesotho and Swaziland. The common theme, though, with Lesotho and Swaziland (which can both comfortably fit in Rift Valley County’s pocket) is that they lack natural resources and therefore must extract as much as possible from the taxable populace. Zimbabwe, without donor budgetary support and improbable access to global debts, has to aggressively ensure that the local revenue stones bleed. On the other extreme is the United Arab Emirates that has generated enough income from its oil resources as to reduce the tax burden on its citizens to almost nil. So all you pesa mashinani stalwarts, please get on your collective knees and pray as follows: Dear Deity of choice, please make Kenya’s oil resources start producing instantly and ensure our government manages the forthcoming revenues expeditiously. If you, Deity of choice, do not like this prayer petition and fail to grant it then please make the Kenyan natives’ stones start bleeding. Profusely. Amen.

Country Tax Collected as a Percentage of GDP

Zimbabwe 49.3%

Lesotho 42.9%

Swaziland 39.8%

United Kingdom 39.0%

South Africa 26.9%

United States 26.9%

Kenya 18.4%

Egypt 15.8%

Rwanda 14.1%

Uganda 12.6%

Tanzania 12.0%

Nigeria 6.1%

United Arab Emirates 1.4 %

Source: Index of Economic Freedom, Heritage Foundation

[email protected]

Twitter: @carolmusyoka

carolmusyoka consultancy

carolmusyoka consultancy

@carolmusyoka

@carolmusyoka